Investing is a bit like rock-climbing this way: a good risk-management plan lets you take risks more confidently, and avoid panicking at the wrong time. This is certainly true in the case of crypto.

In this post:

- I discuss the unique risk/reward profile of crypto-currencies, using Bitcoin as my example.

- I argue that volatility control is a poor risk-management paradigm for crypto: VOLATILITY IS THE POINT.

- I illustrate how drawdown control lets investors achieve a more attractive trade-off between upside capture and downside protection than volatility control.

The analysis builds on my 2018 Journal of Risk paper and my white paper with Alice Wang.

The Risk/Reward Profile of Bitcoin

Crypto-currencies have a remarkable risk/reward profile. Over 2011-2018 Bitcoin delivered returns of 260% a year, for a volatility of 165% a year. That corresponds to a solid Sharpe ratio of 1.56. In comparison, over the same period, the S&P 500 had a Sharpe ratio of 0.87. Hence, even controlling for the fact that 2011-2018 was ‘‘risk-on’’ for most assets, Bitcoin delivered twice as much returns per unit of volatility than the S&P 500.

Finance Reminder — the Sharpe ratio is the ratio of returns (net of the risk-free rate) to the volatility. It is independent of leverage. It lets us compare the attractiveness of returns controlling for implicit leverage.

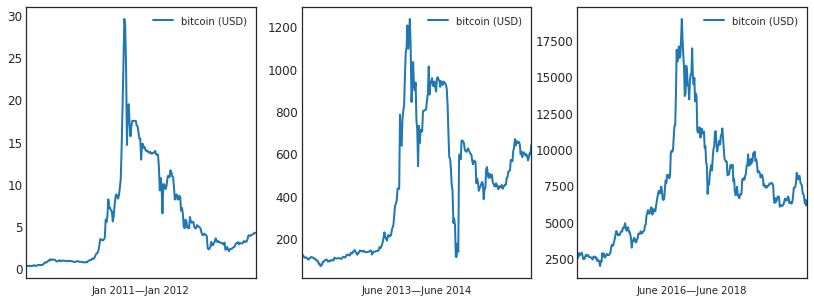

The catch is that Bitcoin can experience very large drawdowns, i.e. very large

peak-to-trough losses. Indeed, since 2011 there have been

three times where Bitcoin lost at least 70% of its value.

In each of the last two crashes, in 2011-2012 and 2013-2014,

Bitcoin actually lost more than 90% of its value.

This makes it very hard for anyone to invest a significant share of their portfolio in Bitcoin or other crypto-currencies. While it may be feasible to HODL for investors who got their crypto for cheap — say in the early days of mining — HODLing seems unbearably stressful for an investor allocating savings accumulated over years of hard work. The obvious danger is that the investor will panic and sell low, only to reenter at the next high.

The goal of risk-management is to help the investor deal with such difficult periods. It’s especially important because panicky investors often end up buying high and selling low. I will discuss two possible approaches:

- Volatility Control — the most common risk-management framework, and the engine at work behind asset allocation strategies such as risk parity (including Bridgewater’s All Weather fund)

- Drawdown Control — (which I’ve written about here) directly targets drawdowns rather than volatility.

Volatility Control

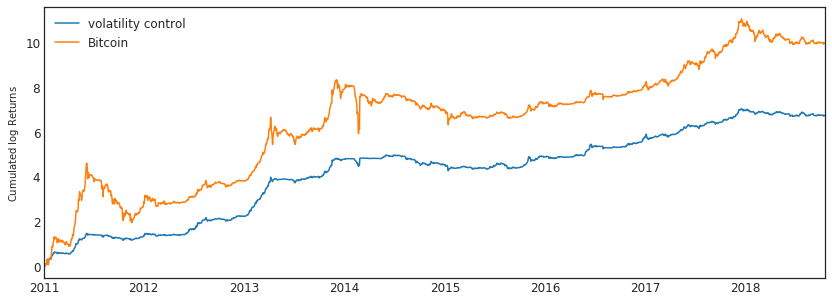

Volatility control seeks to maintain constant the volatility of the portfolio through the cycle. Formally, the share of the portfolio invested in risky assets will be proportional to the inverse of a recent estimate of volatility.

A noteable feature of volatility control is that expected returns over the cycle play no role in sizing the exposition to risky assets. Over the course of a boom-and-bust cycle, the strategy will maintain a constant volatility exposure. This means that in order to keep drawdowns manageable, say 50%, it is necessary to reduce the risk exposure even in good times, which will considerably reduce aggregate returns. The simulation below illustrates this. In order to keep drawdowns below 50%, the volatility target must be set to 32%.

Volatility control has a big impact on performance. On the one hand, the Sharpe ratio increases to 3.3 vs 1.56 for Bitcoin. On the other hand, annual returns are divided by two: they are now 130% vs 260% for Bitcoin. This difference compounds: over the last 5 years, this volatility control strategy would have resulted in a final wealth 32 times smaller than just holding Bitcoin!

Why Volatility Alone is a Poor Measure of Stress

Volatility alone does not correctly capture the level of stress that an investor faces. I claim that volatility on the upside feels fine. It is drawdowns that hurt. As a result, volatility control gives up a large amount of upside to attain an unobjective that does not really make investors feel better.

Indeed, when the Sharpe ratio of an asset is high, volatility is a benediction. One does not get rich from Sharpe, one gets rich from returns, and net returns = Sharpe ratio x volatility. That’s one of the reasons why investing in real estate is often attractive: by letting investors borrow 5 times their downpayment, it lets them increase the volatility of their portfolio. Bitcoin’s volatility should be attractive to an investor for the same reasons leverage is attractive to a real estate investor. Volatility is the point!

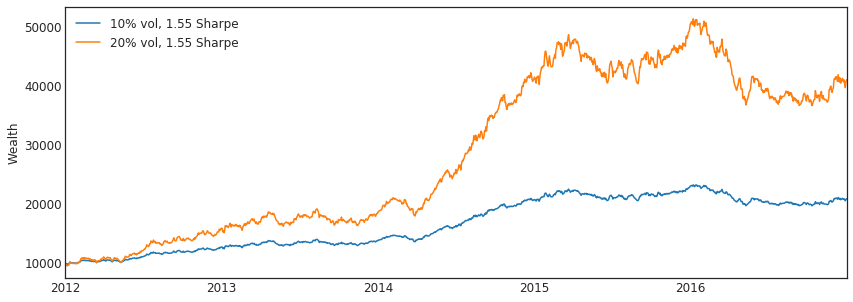

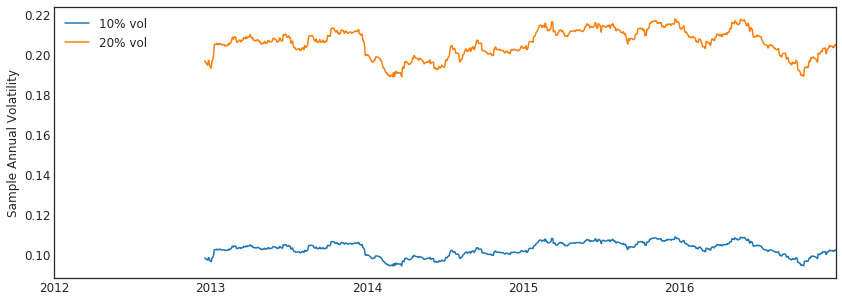

As an illustration I plot how $10,000 would grow over five years, if

invested in two funds with the same historical Sharpe as Bitcoin (~1.56), but

with

10%

vs 20% volatility. Investing in the higher volatility

fund would certainly be a more stressful experience, but it achieves more

than double the final wealth of the 10% volatility fund. It is

interesting to look at the

sample volatility of each fund over time: while there are some

fluctuations, it is largely very stable.

While the funds have roughly constant volatility, it’s pretty clear that the stress level of an investor would vary over time: 2014-2015 would feel fantastic, whereas 2016-2017 would feel terrible. This highlights that volatility just does not properly capture investor stress. Drawdowns, rather than volatility measure how stressful holding an investment is.

The value of this insight is that once drawdowns become the target for risk-management, it’s possible to vary volatility exposure over a boom-and-bust cycle. As a result, one can potentially reduce drawdowns without giving up on the upside.

Drawdown Control

Drawdown control (see our methodology section) seeks to minimize traditional drawdowns against the safe asset, as well as drawdowns relative to a risky benchmark (here Bitcoin). By using methods from robust control, we have shown here and there that it is possible to achieve attractive trade-offs between upside capture and downside protection once the target is drawdowns rather than volatility.

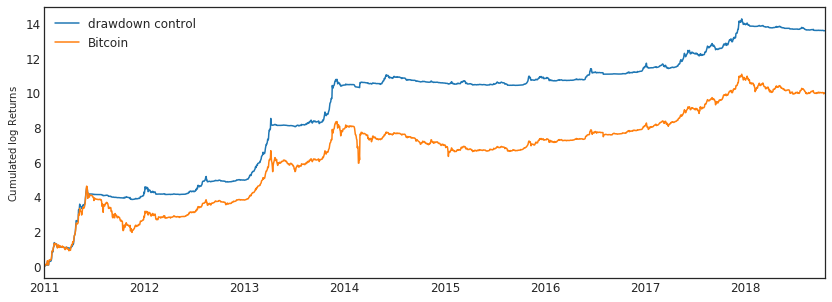

The results speak for themselves. I plot below the cumulated returns of a drawdown control strategy where the maximum leverage is adjusted so that maximum drawdowns against the safe asset are equal to 50%. Because the strategy cuts losses effectively during downturns, the strategy tolerates leverage up to 150% while keeping drawdowns under 50%. The resulting Sharpe ratio is 5.05 and turns out to be better than under volatility control. More importantly, keeping drawdowns equal to 50%, returns are much higher than under volatility control: 470% rather than 130%.

The immediate implication is that for investors whose aversion to risk is better described by drawdowns rather than volatility, drawdown control is a much better risk-management strategy than volatility control. As the table below summarizes, it sacrifices a lot less performance in order to achieve the same risk-management objectives. This insight seems especially appropriate in the context of crypto-currencies that exhibit large Sharpe ratios, large drawdowns, and large returns.

| minmax drawdown | volatility control | bitcoin | |

|---|---|---|---|

| Sharpe | 5.05 | 3.30 | 1.56 |

| annualized returns | 470% | 130% | 260% |

| max drawdown | 50% | 50% | 93% |

| volatility | 93% | 32% | 165% |